We all know the feeling, a destination has been on your list for months or even years but you can’t book because you don’t have the necessary funds. It’s frustrating and you’re probably spending a lot of time day dreaming about the feeling of finally being there. If this described your current situation then it may be time for you rethink how you manage your money. Follow our simple tips on how to save money for travelling and you don’t need to be a millionaire to board that plane.

1 Have a plan

Whether you’re notoriously undisciplined at managing your bank account or you already have a proper budget in place, the quickest way of saving money for travelling is always to create an achievable, measurable plan first.

Be organised and research how much you need to save, determine when you want (or it’s realistic) to go and how much you need to save each month to get there. The most important thing about a saving plan is sticking to it, so make sure your goal is realistic! While it’s easy to say you’re putting all money aside that’s not going towards bills, it’s not going to happen. You will fall behind on your plan and probably just quit on it all together. You’re likely going to save for 6 – 24 months and you still want to live! So make sure you include enough money for social activities, occasional treats and life admin in your calculations. Although we might dislike the expense, we all have to get our hair cut, right?

2 Review your outgoings

Reviewing outgoings is something everyone should do on a regular basis, if you’re saving for a holiday or not. These days it’s easy to have recurring, monthly subscriptions coming out of our bank account we don’t need in our lives.

This can be the gym, app store purchases and the list goes on. If you don’t use the facilities at the gym (despite what you might be telling yourself) then it’s time to quit. If you’re subscribed to a game on the app store you haven’t used in the last month, cancel it right now before you forget! Subscriptions are cunning cycles if you tell yourself you have another two weeks to cancel because, guess what, you forget about them! It may only be a few pounds per subscription but these numbers add up quickly. Even if you’re only able to cut down £10 per month, if you’re not using it, it’s all money that’s better spent on travel.

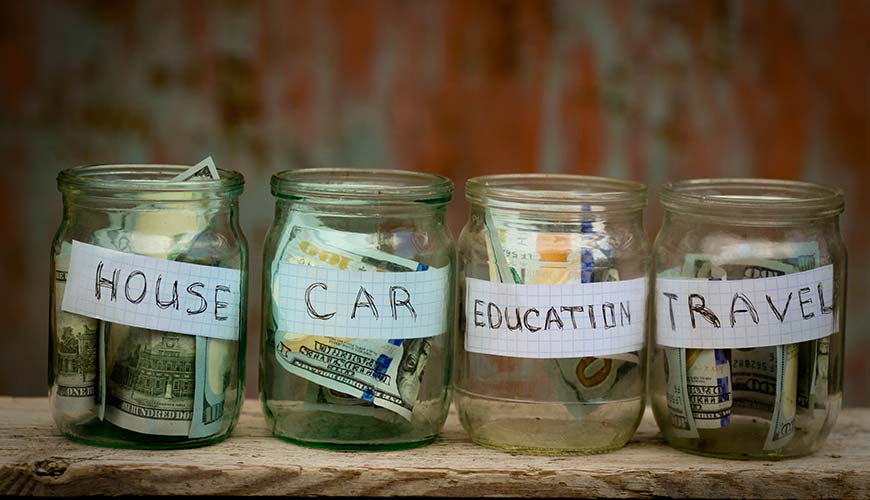

3 Get a money jar

Money jars can be a great tool to help you save money for travelling without realising. Create a rule for when or how much money you’re putting into the jar. For example, every time you have a £1 coin you have to put it in the jar or you have to put all the cash left in your wallet in the jar every Sunday. You don’t even need to waste money on the jar, just get an empty jam glass and start saving! If you’re the creative or visual type then making your money jar look pretty might help you wanting to feed the beauty. Want to go to Cambodia? Decorate your jar with pictures of Angkor Wat.

You never have cash on you? If you’re fully embracing the digital age then do some research on bank accounts and credit cards that reward you for spending your money electronically. Some current accounts allow you to “round up” every time you tap your card and will move it into a separate pot of money for you. That way you’re saving money as you’re spending it, genius!

4 Get a new coffee routine

In the last few years coffee shops have popped up on every corner and it’s easy to grab a coffee before work or head to the coffee shop across the road for a five minute break. Now, we are not suggesting you give up coffee altogether, because in all honesty, nobody wants to talk to you before you’ve had your morning coffee. Instead you can buy premium instant coffee for the office or you can invest into a decent travel mug for your commute. We promise you’ll wonder where all the money in your bank account has come from at the end of the month.

5 Food

It’s Monday night, the first day back at work after the weekend and you can’t bring yourself to make a packed lunch for the next day? In a world where you can get food delivered to your office door and there are too many restaurants to choose from within walking distance it’s easy to go with the flow and buy lunch every day. If you don’t go out much, your monthly bills are within reason and yet your bank account seems to eat its own money then the reason is probably the work lunch trap!

One of the best ways to save money for travelling is cooking yourself, at least most of the time! You don’t need to spend hours in the kitchen every day to prepare packed lunches. You can either cook in bulk on a Sunday afternoon or keep ingredients for sandwiches at work. Stay disciplined and you’ll be on holiday sooner than you thought!

6 Cut down on alcohol

You’ll be surprised how much alcohol you’re consuming and the amount of money that seems to disappear with it once you start monitoring your intake. It’s not about the drink you’re having at home on a Saturday night, it’s the work drinks at the pub on Thursdays and Fridays. Your social life should not be non-existent while you’re saving so give yourself some realistic, sustainable goals. Drink slowly to cut down your intake or choose to go for drinks one evening a week rather than two. You know how healthy products usually cost double the price? Well, in this case a healthier you equals a healthier purse.

7 Stay on track

It can be very easy to lose sight of your budget and to make exceptions that turn into the norm. There are several tricks which can help you stay on track. Visualising is one of them. Get on excel or grab a blank piece of paper, jog down your budget and review it on a regular basis. This can be daily, weekly – whatever works for you. Another way of resisting the temptation to sweep your bank account is keeping a picture of your next travel goal in your wallet. You will think about spending money twice every time you reach for your wallet.

Just bear in mind that different things work for different people so play around a bit and see what is keeping you motivated. Don’t be too harsh with yourself if you do have small setbacks, saving a few pounds less than planned one month is still better than not saving anything at all.

8 Have realistic expectations

Don’t cut your monthly spending money to the bare minimum. It’s unlikely you will stick to it long-term and you will probably scrap it altogether, meaning you won’t save money for travelling. Include your social life and occasional treats in your budget. You might save a little less each month but you will follow your plan without getting frustrated.

9 Sell stuff

Selling old things is a great way to make some extra cash. Have a look through old DVDs, furniture, clothes, video games or whatever it is that is collecting dust in the dark corners of your home. We’re all guilty of keeping things that make us reminisce about the good old times but have you actually used it in the last few months? Did you even know you still had it?! You won’t get rich but your savings account will definitely approve and your home will be clutter-free.

10 Compare prices

Comparing prices applies to everything in life, from the lettuce you’re buying to your broadband provider. Do you regularly go to the overpriced convenience store around the corner rather than big superstores? Then you’re probably overspending significantly on your monthly groceries. It’s only £10-20 per week more I hear you say? True, and that’s a monthly £40-£80 you could be contributing towards your travel plans. You can take this even further if you’re in charge of your utility bills and make sure you’re still on the most competitive plans. Voila, a quick and easy way to be save money for travelling.

It definitely takes some time and effort when you first start but once you get into the routine you’ll wonder why you’ve ever done things differently.

Here at Tucan Tavel we always have weekly deals on offer for budget conscious travellers. Take a look at our travel deals or sign up to our newsletter if you want to be the first to know about secret offers!

Anna is on the marketing team at Tucan Travel. From a young age Anna has travelled solo and on group tours through Europe, Africa, the Americas and Southeast Asia. You can find her on LinkedIn here.

Spread the love